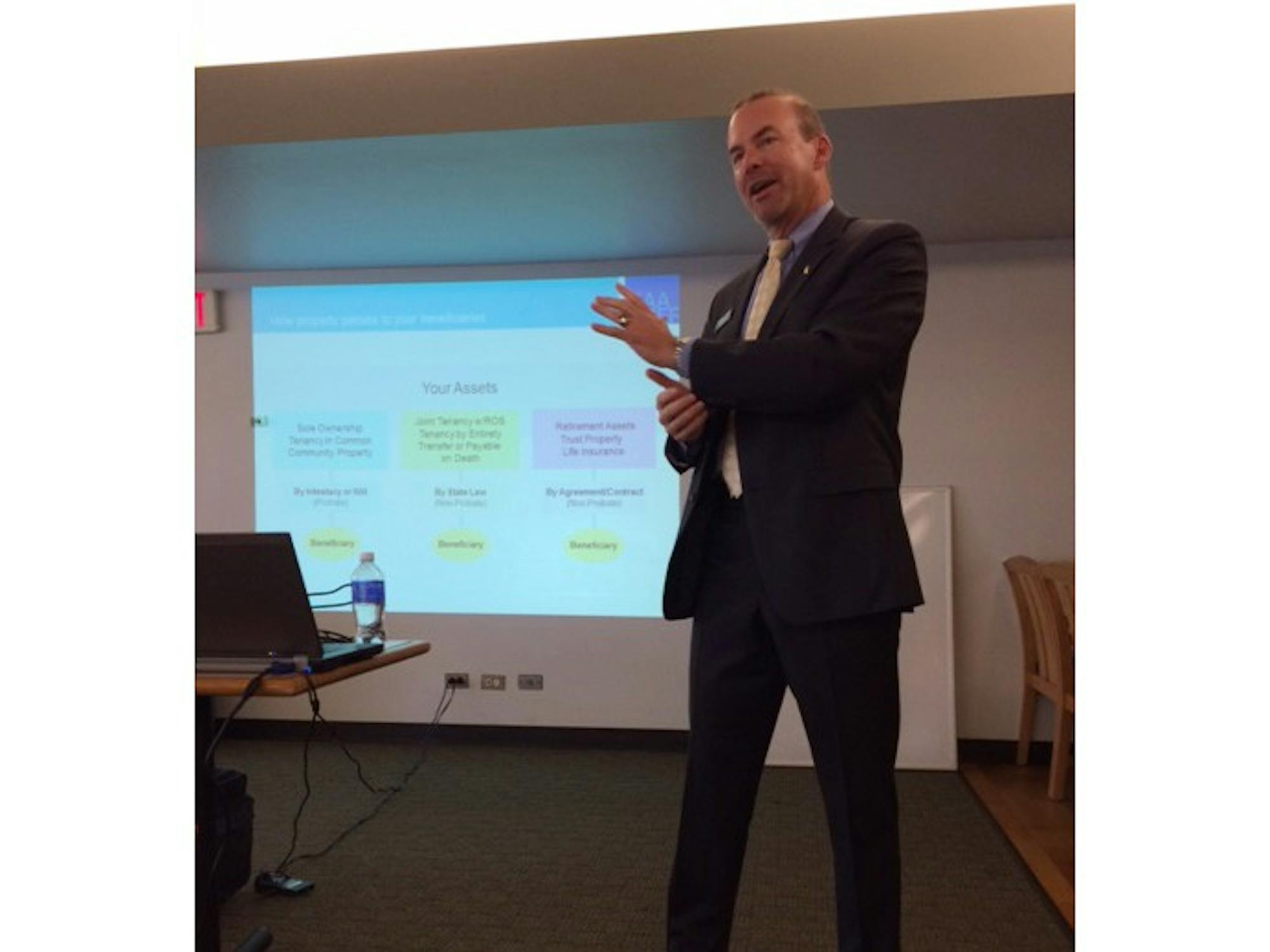

Alan Jesiel, wealth management advisor from the Teachers Insurance and Annuity Association of America-College Retirement Equities Fund, spoke to Eastern Michigan University staff about the importance of having a solid estate plan in place.

EMU's human resources department held its weekly Fifth Floor Fridays session Thursday in the Recreational and Intramural center. Thursday’s session focused on estate planning and financial wellness.

Jesiel said he feels that planning for a stable future financially is crucial and thinks both staff and students should attend.

“Knowledge is power, people need to be knowledgeable to take care of themselves and an elderly parent for their retirement and in life,” he said. “What you are going to have in retirement is what you save on your own. And the earlier you save, the better off you will be later.”

The lecture was broken into two segments: lifetime planning goals and estate planning considerations at death.

During the lifetime planning segment, he touched on topics such as making living arrangements if you become disabled, how to choose a power of attorney and revocable trusts. In the death-planning segment, he discussed how to choose beneficiaries, passing property to beneficiaries, last will and testament and estate tax planning.

Throughout the lecture, Jesiel emphasized the importance of creating a will and having beneficiaries. He said that if not, your estate is subject to intestacy and is subject to probate court. If you don’t name a beneficiary, the state will make the final decision.

Jesiel gave advice to college graduates.

“You might be paying off student loans or saving for a car or condo, but when you get your first real job, get into the retirement plan as soon as you can,” he said. “You should contribute at least enough to max out the company match.”

Anne Fo, account analyst in EMU’s grant and accounting department, said that the event was really beneficial to her because she is single with no dependents and wanted to learn some tips on what to do. She said she not only feels that it’s good for staff and people close to retirement to learn about estate planning but also students and young people.

“The younger you start, the better,” she said. “Young people should put away 10 percent of their income because if you start younger, you will have more money and it keeps growing and growing. You don’t need big lavish things now, you can save that money and put it to good use. Use your spending wisely.”

Emily Tefft, senior account analyst in the grant and accounting department, attended with Fo. She made sure that she learned the information while she’s still young.

“Everyone needs to know, more information doesn’t hurt,” she said. “If you don’t learn it, you will be working until you are 100 years old or going to have to depend on your children. You will be a burden on someone else. It’s not only until the day you retire, but it’s the 30-plus years after that you have to also worry about.”